Employees are a crucial asset to any organization, as their skills, talents, and abilities are fundamental to its success. There continue to be, however, growing instances where employees exploit their positions for personal gain at the expense of their employer. Such breaches not only lead to financial loss but also highlight major gaps in fraud detection and prevention technology, business risk management solutions, and anti-money laundering compliance checklists. When these issues occur, they undermine the unspoken trust that forms the foundation of the employer-employee relationship.

Rise in Employee Misconduct

In 2024, several high-profile cases of employee misconduct emerged, highlighting the misuse of confidence by employees in India. While sometimes referred to as corporate governance lapses, these incidents question the adequacy of risk mitigation data check systems and AML investigations processes. When senior employees exploit their authority for financial gain, it demonstrates a significant lapse in fraud controls and business risk investigation services.

Examples – Workplace Fraud

In a recent event, a former senior financial analyst at a major technology company was arrested for embezzling ~US$380,000 over eight years. This case underscores the importance of fraud investigation tools and real-time adverse media alerts for AML to detect red flags earlier. Tasked with managing payroll and settlements, the individual exploited unclaimed payments by creating forged documents and redirecting funds to personal accounts. The fraud involved diverting money meant for ~200 former employees into 50 different accounts.

Another example involved an HR associate director at a Singaporean company who was sentenced to 18 months in prison for embezzling US$153,000. Such cases underline the necessity for robust KYC verification checks and digital footprint analysis for compliance in identifying risks before they escalate.

Common Types of Employee Fraud

Employers face a wide range of fraud risks, which require fraud risk management solutions and business risk assessment tools. Some recurring patterns of misconduct include:

- Embezzlement or theft of assets

- Skimming funds through revenue diversion

- Inflated bills, expenses, and allowances

- Theft or diversion of business opportunities, client lists, or proprietary data

- Amendment of company policies to benefit one or a few senior employees

- Fake invoicing for GST evasion or revenue exaggeration

Preventing Employee Fraud

Given the prevalence of employee-related fraud, companies must adopt tech-enabled fraud detection approaches along with senior professional screening strategies. To effectively reduce the risk of such incidents, companies can consider various measures, including:

1. Comprehensive Employee Background Checks

Use adverse media screening services and RegTech platforms in addition to standard verification. For Indian companies, adopting KYC check software providers can further ensure accuracy.

2. Engage with Employees Regularly

Senior managers, executives, and business owners should consistently interact with employees at all levels to build strong relationships and gain insights into their areas of responsibility. Proactive involvement helps mitigate business risks and reduces opportunities for misconduct.

3. Anonymous Whistleblower System

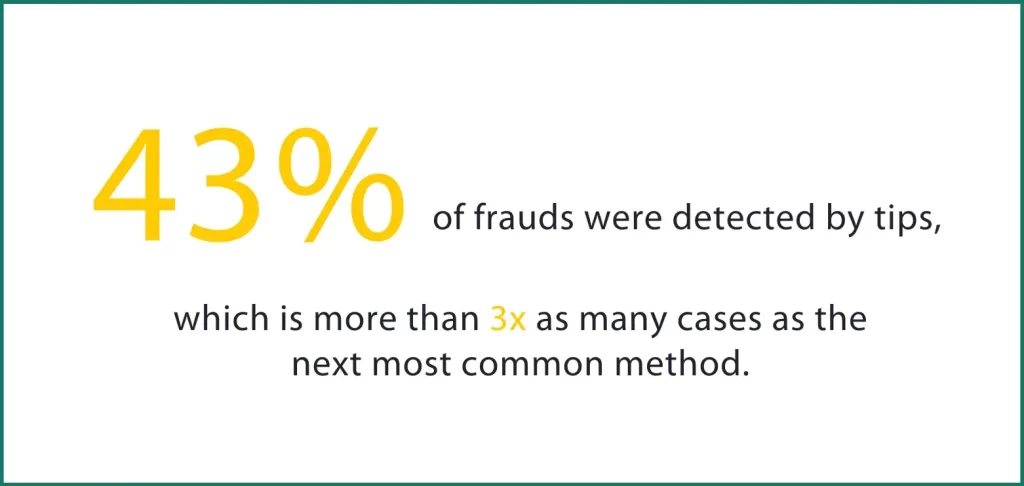

Establish a system for anonymous reporting, such as a suggestion box, where employees can safely voice concerns or report misconduct. Ensuring anonymity is crucial for maintaining the integrity and effectiveness of the policy.

Source: ACFE

4. Control Cash Transactions and Formalize Procurement Processes

Minimize cash transactions by enforcing strict documentation and approval procedures. For capital expenditures, mandate formal purchase orders and ensure that the finance department obtains at least three independent quotes, including screengrabs of online offers. Additionally, rely on tech-enabled vendor management services with a vendor due diligence checklist template to add accountability.

5. Foster Organizational Loyalty

In many Asian cultures, there is a strong expectation for community members to support each other, which can sometimes lead to employees being loyal to an individual rather than to the organization. To counteract this, organizations should cultivate a keen sense of belonging through interactive and team-building activities. This approach helps reduce the risk of collusion and focuses employees on the company’s goals.

6. Regularly Review Vendor and Supplier Relationships

Competent managers should frequently engage in discussions with vendors, service providers, and suppliers, sometimes without the presence of employees who interact with these stakeholders regularly. These conversations should focus on working relationships, address any integrity or conflict issues, and resolve any grievances. You can also implement vendor due diligence consulting and risk-based vendor due diligence solutions.

7. Maintain Robust IT Security Measures

Ensure that computer passwords are updated regularly and that IT access restrictions are consistently enforced to maintain security.

8. Conduct Frequent Employee Training

Provide frequent training to all employees on the importance of ethics, maintaining confidentiality, and the zero-tolerance policy for breaches. Regular sessions should reinforce AML best practices and KYC due diligence best practices.

Responding to Employee Fraud

Even with preventive frameworks like sanctions screening software and fraud investigation services, some incidents may occur. In such cases, several actions can be taken to manage and mitigate the associated risks effectively.

1. Legal Actions and Civil Liabilities

Organizations may pursue legal action against employees involved in fraud. Under the Companies Act 2013, both civil and criminal liabilities can be imposed on fraudsters. For more complex cases, investigations can be initiated through a special resolution or at the request of the Central Government. Section 447 of the Companies Act specifies penalties for fraud, aligned with PMLA compliance and reporting.

2. Handling Data Theft and Cybercrime

Employee fraud can involve data theft, where an employee with access to sensitive information pilfers a copy and potentially joins a rival company. If a company becomes a victim of data theft, it should file a criminal complaint with the local police or state-level cybercrime units.

3. Civil Lawsuits and Compensation Under the ITA Act

Breach of contract disputes may result in civil lawsuits. Data theft is a criminal offense under the Information Technology Amendment Act 2008. If a company suspects data theft by a former employee, it can pursue a civil case to seek compensation. Section 43 of the ITA Act provides for substantial compensation in such cases. Organizations may pursue civil remedies while leveraging in-depth investigation services and quality structured information providers for evidence.

Conclusion

Employee fraud leads to immense financial and reputation losses. Companies should combine tech-enabled AML check solutions, fraud detection and prevention technology, and risk mitigation solutions with internal monitoring. These technology-enabled frameworks for compliance and business risk management solutions can safeguard organizations against money laundering, fraud, and reputation threats effectively.

Explore Alea’s Employee Fraud Prevention and Risk Management Services