Employees are a crucial asset to any organization, as their skills, talents, and abilities are fundamental to its success. There continue to be, however, growing instances where employees exploit their positions for personal gain at the expense of their employer. When such breaches occur, they undermine the unspoken trust that forms the foundation of the employer-employee relationship.

Rise in Employee Misconduct

In 2024, several high-profile cases of employee misconduct emerged, highlighting the misuse of confidence by employees. While sometimes referred to as corporate governance lapses, these incidents raise doubts about the comprehensiveness of internal checks and balances, which may have been bypassed or failed, to prevent such frauds. When senior employees exploit their positions for financial gain, it indicates a significant gap in the internal mechanisms.

Recent Examples of Workplace Fraud

In a recent event, a former senior financial analyst at a major technology company was arrested for embezzling ₹32 million (~US$380,000) over eight years. Tasked with managing payroll and settlements, the individual exploited unclaimed payments by creating forged documents and redirecting funds to personal accounts. The fraud involved diverting money meant for ~200 former employees into 50 different accounts.

Another notable case involved an HR associate director at a Singaporean company who was sentenced to 18 months in prison for embezzling ~S$200,000 (US$153,000) through fraudulent expense claims. Merely two months after starting the role, the person began submitting bogus claims for travel, mobile phone expenses, holiday allowances, and other incidentals, until they were caught.

Common Types of Employee Fraud

Publicly reported cases of employee fraud are still only the tip of the iceberg. Employers and management encounter a higher number of fraudulent activities, including:

- Embezzlement or theft of assets

- Skimming funds through revenue diversion

- Inflated bills, expenses, and allowances

- Theft or diversion of business opportunities, client lists, or proprietary data

- Amendment of company policies to benefit one or a few senior employees

- Fake invoicing for GST evasion or revenue exaggeration

Preventing Employee Fraud

Given the prevalence of employee fraud, it is crucial for employers to be prepared for its aftermath and to establish a robust internal control system. To effectively reduce the risk of such incidents, companies can consider various measures, including:

1. Comprehensive Employee Background Checks

It is essential for companies to conduct thorough and individualized background checks to verify potential employees. This process must go beyond standard procedures, including detailed verification of a candidate’s previous roles and responsibilities, validation of their professional qualifications, and scrutiny of any discrepancies in their application. A cursory or limited check does not suffice for senior or critical roles.

Discover how an employee background screening uncovered hidden conflicts of interest and non-disclosure issues in a high-stakes procurement case. Learn more about our comprehensive approach and the critical findings that safeguarded our client’s reputation.

Read the full case study here

2. Engage with Employees Regularly

Senior managers, executives, and business owners should consistently interact with employees at all levels to build strong relationships and gain insights into their areas of responsibility. For senior managers, staying actively involved with their team not only helps in monitoring performance but also serves to motivate and engage employees.

3. Anonymous Whistleblower System

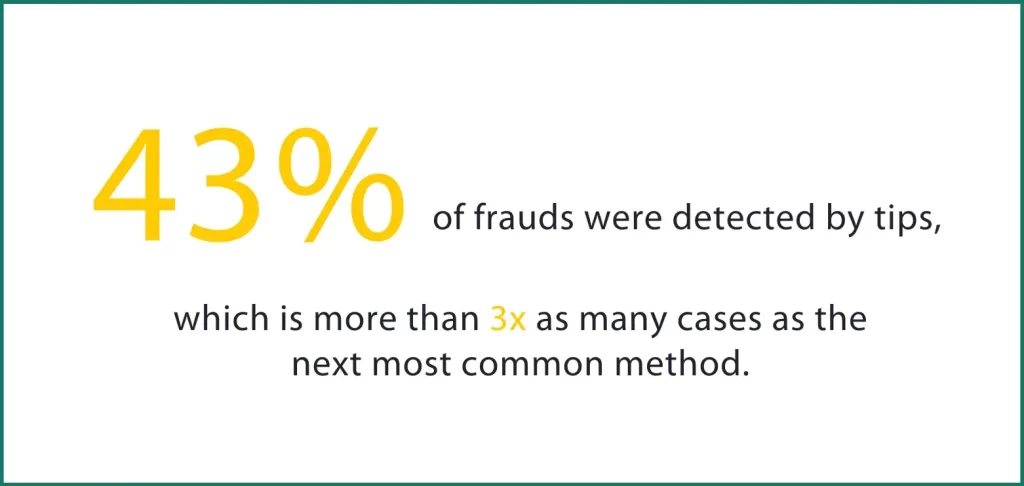

Establish a system for anonymous reporting, such as a suggestion box, where employees can safely voice concerns or report misconduct. Ensuring anonymity is crucial for maintaining the integrity and effectiveness of the policy.

Source: ACFE

4. Control Cash Transactions and Formalize Procurement Processes

Minimize cash transactions by enforcing strict documentation and approval procedures. For capital expenditures, mandate formal purchase orders and ensure that the finance department obtains at least three independent obtained quotes, including screengrabs of online offers.

5. Foster Organizational Loyalty

In many Asian cultures, there is a strong expectation for community members to support each other, which can sometimes lead to employees being loyal to an individual rather than to the organization. To counteract this, organizations should cultivate a keen sense of belonging through interactive and team-building activities. This approach helps reduce the risk of collusion and focuses employees on the company’s goals.

6. Regularly Review Vendor and Supplier Relationships

Competent managers should frequently engage in discussions with vendors, service providers, and suppliers, sometimes without the presence of employees who interact with these stakeholders regularly. These conversations should focus on working relationships, address any integrity or conflict issues, and resolve any grievances.

7. Maintain Robust IT Security Measures

Ensure that computer passwords are updated regularly and that IT access restrictions are consistently enforced to maintain security.

8. Conduct Frequent Employee Training

Provide frequent training to all employees on the importance of ethics, maintaining confidentiality, and the zero-tolerance policy for breaches. Additionally, conduct random background checks to detect any lifestyle changes that may indicate discrepancies with known sources of income.

Responding to Employee Fraud

Even with robust preventive measures, employers may still encounter instances of fraud. In such cases, several actions can be taken to manage and mitigate the associated risks effectively.

1. Legal Actions and Civil Liabilities

Organizations may pursue legal action against employees involved in fraud. Under the Companies Act 2013, both civil and criminal liabilities can be imposed on fraudsters. For more complex cases, investigations can be initiated through a special resolution or at the request of the Central Government.

According to Section 447 of the Companies Act, individuals convicted of defrauding a company of ₹ 1 million or more than 1% of the company’s annual turnover, whichever is lower, face imprisonment ranging from 6 months to 10 years. Additionally, they may be fined an amount equal to or up to three times the sum defrauded.

2. Handling Data Theft and Cybercrime

Employee fraud can involve data theft, where an employee with access to sensitive information pilfers a copy and potentially joins a rival company. If a company becomes a victim of data theft, it should file a criminal complaint with the local police or state-level cybercrime units.

3. Civil Lawsuits and Compensation Under the ITA Act

Breach of contract disputes may result in civil lawsuits. Data theft is a criminal offense under the Information Technology Amendment Act 2008. If a company suspects data theft by a former employee, it can pursue a civil case to seek compensation. Section 43 of the ITA Act provides for substantial compensation in such cases.

Conclusion

Companies incur significant losses in responding to employee fraud (expenses, litigation, and cost of management time). To mitigate this effectively, a solid strategy is essential, combining strong preventive measures with proactive response plans. Key steps include thorough background checks, regular employee engagement, and tight internal controls. However, many organizations may not have the specialized tools or expertise to handle these issues effectively on their own. In such cases, partnering with service providers can be highly beneficial, as these professionals’ help ensure a thorough and effective approach to safeguarding your organization’s financial and reputational health.